At one time or another, most people have dreamt of owning a place where they can get away from it all, whether it be a cabin overlooking a scenic mountain range, a quaint cottage near the lakeside or a breezy bungalow a few steps from the beach. What does it take for buyers to turn those sun-soaked dreams into a reality?

At one time or another, most people have dreamt of owning a place where they can get away from it all, whether it be a cabin overlooking a scenic mountain range, a quaint cottage near the lakeside or a breezy bungalow a few steps from the beach.

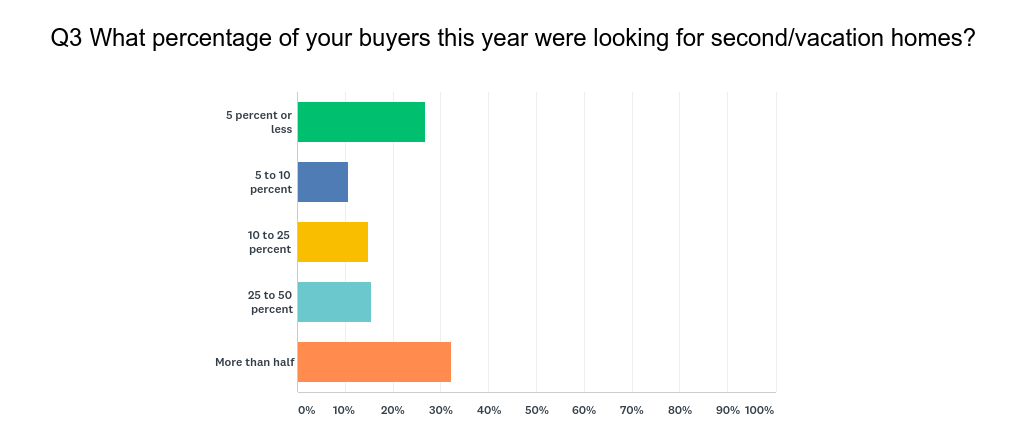

In fact, 32 percent of respondents for our survey on second homes and vacation homes said more than half their buyers this year were looking for a second home. But, what does it take for buyers to turn those sun-soaked dreams into a reality?

Credit: Pedro Correa/Inman

Financing and affordability of second homes

New second-home buyers can make the mistake of assuming the cost of purchasing and upkeeping another pad will be exactly the same as their primary residence, which couldn’t be farther from the truth. From down payments to mortgage rates and basic upkeep, there are plenty of extra costs that can blindside buyers.

Purchase options

When it comes to comparing primary home and secondary home median sales prices, there’s not too much of a difference according to the National Association of Realtors’ 2017 Investment and Vacation Home Buyer’s Survey. In the survey, 2,099 buyers reported paying, on average, $200K for a secondary home — $31,700 less than what they spent on a primary home.

According to Inman’s survey, the majority of buyers (40.12%) spent anywhere from $250–500K for their vacation home, which isn’t too bad considering that the median existing-home price for June 2018 ($276,900) fits within that price range.

Although the similarity in cost between primary and secondary homes may offer some relief to buyers who thought they had to spend in excess of $1 million, there is a notable difference in upfront costs.

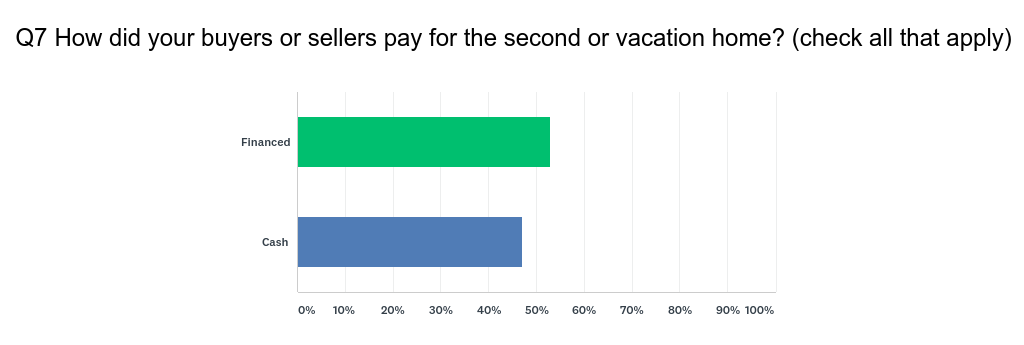

Fifty-three percent of buyers used financing.

In 2017, buyers had an overall median down payment of 10 percent and nearly 61 percent of first-time buyers were able to put down anywhere from zero to six percent, thanks to Fannie Mae and Freddie Mac’s push to make accessing credit easier for first-time buyers. But buyers who are purchasing a second home for exclusive use or for short-term rental investment often don’t have the option of putting down less than 20 percent.

Consumer finance expert, The Basis Point founder, and Zillow contributor Julian Hebron says buyers can put down as little as 20 percent for a secondary home and can qualify for a loan using the full primary residence cost plus the full second home cost.

“Mortgage rates and tax benefits are the same as primary residences,” Hebron wrote in his post for Zillow. “But lenders won’t let you rent the home.”

The estimated costs for a $600K home in Sonoma County, Calif. (Credit: Zillow)

If a buyer is buying a second home as an investment, Hebron says they need to be prepared for higher mortgage rates and a down payment of at least 30 percent.

“You can rent the home and use it when it’s not rented,” he wrote. “Rates are .25 percent to .375 percent higher than second home rates, and your down payment usually starts at 30 percent.”

“You qualify for the loan using your full primary residence cost plus your full investment home cost, but you can use rental income to help qualify,” Hebron added. “Tax treatment is less beneficial, but the extra income can help with affordability.”

For buyers who don’t have an extra $60K in the bank for a down payment, there are a couple options to make the upfront costs more manageable.

Experienced real estate investor Whitney Nicely says buyers should consider using home equity line of credit (HELOC).

“If it’s possible for you to pull a line of credit on your primary, and you can use that as the down payment for your secondary,” Nicely told Inman. “But maybe also get enough where you can buy a boat for your lake house with that line of credit. Maybe you can factor in getting new furniture with that line of credit or add another bathroom. Those are things that add value.”

When a buyer uses a HELOC, they’re able to get a loan up to 85 percent of their primary home’s appraised value minus the remaining balance on the first mortgage, noted an explainer on Credit Karma. The interest rates will vary and are based on the buyer’s credit score, credit history, and income.

Before pursuing a HELOC, especially for the purpose of buying an investment property, real estate agents need to make sure buyers understand the risks and costs of managing a rental. If an investment property doesn’t yield enough profits and the buyer defaults on the HELOC payments, the bank can take their primary home.

To be safe, Nicely says buyers need to sit down, write a budget, and then double it. That way, she says, you’ll have a cushion in case something doesn’t go to plan.

Lastly, buyers can consider entering into a fractional ownership agreement, said Dallas-based real estate blogger and vacation home owner Candace “Candy” Evans.

“You have a portion of actual ownership over the property, and you’re just designated certain times to use it, and some of the better fractional ownership programs allow you to jump around to various locations,” said Evans who has shared full ownership at a ranch in the Texas Hill Country, and is considering a fractional ownership agreement at San Francisco’s Fairmont Heritage Place.

At Fairmont Heritage Place buyers have access to a two-bedroom, 1,350 square-foot apartment at a minimum for 35 days a year and 1/10 deeded ownership. The company says a buyer will pay $12,700 per year in HOA fees and $2,500 in taxes, which is based on a $220,000 acquisition cost. In addition to hotel-quality services, buyers are able to exchange their deeded ownership to other Fairmont properties around the world.

Beyond eliminating the upfront costs for whole ownership, Evans says buyers are attracted to the fact that they don’t have to worry about maintenance.

“That’s the big issue with second homes, there’s a lot of maintenance involved, she said. “You don’t want to end up spending all your [vacation] time fixing things or waiting on a repairman. You want to enjoy your vacation.”

Although fractional ownership may seem like the perfect alternative to full ownership, there are some drawbacks. Most obviously, buyers won’t have the freedom to make changes to the property, and they’ll only have access to the property at scheduled times. Furthermore, if a buyer is entering into a fractional ownership agreement with a smaller number of people, they must trust that their co-owners will hold up their end of the bargain.

“Fractional ownership involves the risks of sharing use of property with others and relying on them to fulfill their obligations to you,” explained San Francisco-based real estate lawyer Andy Sirkin on his firm’s blog. “Sharing obligations means that necessary maintenance and management might not be completed, or worse, that as the result of a co-owner failing to make a payment, a mortgage lender could foreclose on the entire building causing all of the other co-owners to lose use of the shared home and possibly all of the money they have invested.”

There is no way to eliminate these risks, but there are ways to lower them,” he added. “Perhaps the single most important thing you can do to lower the risk of shared ownership is to have a thorough, written, signed fractional ownership agreement that deals with all of the issues, including events you don’t expect to happen, the possibility that people you don’t know will be in the group as the result of a death or re-sale, and the reality that people change and you might not get along with the other co-owners as well as you do now.”

Considering the costs of insurance, utilities and maintenance

Now that your buyer has considered the down payment, mortgage rates, monthly mortgage and alternative purchase options, there’s a host of other costs they must add into the mix, including insurance, utilities and maintenance costs.

When it comes to insurance, a basic home insurance policy that covers damage from weather events (storms, wind, hail, snow, etc.), non-weather events (theft and vandalism) and accidental direct physical loss (e.g. water from plumbing) won’t do.

They’ll also need to consider other natural disaster insurance policies that are specific to their area. For example, if a buyer’s vacation home is near a waterfront, they’ll need to purchase flood insurance through the National Flood Insurance Program and purchase a windstorm policy so their home is covered if a hurricane blows through. If the vacation home is in California, a buyer will need to consider purchasing earthquake insurance.

But no matter what region the buyer is in, they must invest in an umbrella insurance policy that offers protection if a short-term renter is injured in your home or if the renter causes any property damage during their stay.

“There is insurance specifically for vacation rentals, and depending on the coverage of the property management company you’re with offers or your existing homeowner policy, the coverage will be different,” said Shaun Greer senior director of real estate for the home rental booking and management platform Vacasa, while suggesting that buyers get a few estimates before making a final decision.

After adding insurance to the monthly budget, buyers must consider maintenance and utility costs. Since the buyer won’t be at their vacation home most of the year, they must hire a property manager to upkeep the interior and exterior condition of the house, make sure the house is stocked with necessities for guests, and take care of any other needs.

“My recommendation to anyone buying a second home that they do intend to rent out is to have someone else manage it even if that means your margin gets decreased,” said PLG Estates founder and broker/owner Peter Lorimer.

“I will always happily pay someone to manage a property for me to make sure that the condition is kept up, to make sure that the tenants are good, to make sure that the air conditioning is working, that the electrical is working, the this and the that, so when I decide to sell this asset in 10 or 15 years, it will be in far greater condition than if I just rented it to death.”

Credit: Zillow and Thumbtack

Finally, buyers have to be prepared for utility costs that are double or even triple that of what they pay for their primary residence, especially if they’re renting it out to large groups.

According to a 2017 joint study by Zillow and Thumbtack, the average homeowner spends $2,953 per year in utility costs. That estimate fluctuates by market — in San Francisco, homeowners spend $3,928 for utilities annually, but homeowners in Indianapolis spend $2,917, $36 below the national average.

So, if your buyer purchases a swanky waterfront property in the Bay for the purpose of renting it out, they should prepare to spend at least $11,000 on utilities per year.

Credit: Pedro Correa/Inman

Vacation home types and options

It’s often said that real estate is all about “location, location, location,” and that’s more so true when it comes to purchasing a vacation home, whether it’s for exclusive or rental use.

Vacasa’s Shaun Greer says the majority of vacation home buyers purchase a home that’s within a 2-to-3 hour driving time from their primary home. That may change, especially if the buyer’s primary home is more than three hours away from a population center, i.e. a big city.

Greer says demand for vacation rentals are highest around these population centers. So a homeowner who wants to do short-term rentals may need to prioritize a potential renter’s needs first and choose a home that’s no more than a three hours drive from the city, even if it results in a greater drive for them when they want to visit.

Buyers should also consider if they’d like to live in a waterfront property, whether it’s by a pond, lake, river or ocean. Massachusetts-based Re/Max realtor Bill Gassett says these properties offer plenty of avenues for fun, but they pose a few special challenges as well.

“When it comes to waterfront properties, people don’t realize there are things you can and cannot do,” said Gassett referring to HOA guidelines that may restrict homeowners use of the lake for boating and other recreational activities to certain days and times.

“If you’ve lived in a single-family home for any amount of time, you’re used to being your own boss so to speak, and then you move into an association and you’re given a long set of ground rules you’re not accustomed to, it can be really shocking and disappointing,” he added. “You have to decide whether you can live with that or not.”

The building trap

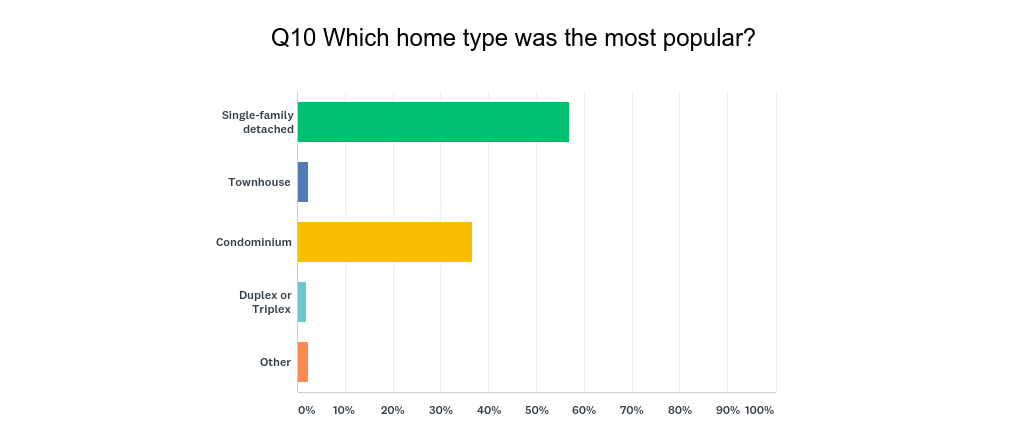

Fifty-six percent of buyers chose a single-family home.

When it comes to home types, single-family detached homes offer the greatest privacy for homeowners, it rakes in the most cash for short-term rent and has greater long-term appreciation value. But, this home type usually comes with a higher purchase price, maintenance and utility costs compared to condos, apartments, and townhomes.

Due to the extra costs and upkeep single-family home require, Greer says newbies often choose a condo as their first second-home purchase.

“What we find is that new buyers who want to purchase a vacation rental depending on their budget and their experience with vacation rentals they lean toward purchasing condos primarily because of concerns about maintaining the exterior of the property,” he said, noting that condo complexes take care of exterior maintenance needs.

Next, buyers will have to consider if they’d like an existing home or want to take on the task of building a home from scratch. The first option is clearly easier — buyers only have to worry about doing a few renovations depending on the quality of the home and the needed rental permits are usually grandfathered in.

“The easiest thing to do is buy an existing vacation rental,” added Greer. “No matter what municipality it’s in, there’s proper documentation for the property to run as a vacation rental.”

“Given the rental regulation changes in all markets, some are grandfathered in and some you have to reapply,” he said. “So that’s all about the due diligence a real estate agent does. At closing, you want to make sure there’s proper paperwork for the vacation rental.”

On the other hand, designing a home allows for complete customization. But if buyers aren’t careful, they can find themselves in a fight with zoning and association authorities that have strict building guidelines.

“[Before you build] you have to do your research on [regulations],” said Gassett, noting that buyers sometimes buy a piece of land with the assumption they can build whatever they want.

In the waterfront communities Gassett serves, homeowners must follow strict HOA guidelines that regulate things such a home’s size, exterior design, and landscaping features. Furthermore, lakefront property owners in his area must abide by state conservation laws that limit construction near wetlands.

Gassett says homeowners must follow The Wetlands Protection Act, which says:

No person shall remove, fill, dredge or alter any bank, riverfront area, fresh water wetland, coastal wetland, beach, dune, flat, marsh, meadow or swamp bordering on the ocean or on any estuary, creek, river, stream, pond, or lake, or any land under said waters or any land subject to tidal action, coastal storm flowage, or flooding, other than in the course of maintaining, repairing or replacing, but not substantially changing or enlarging, an existing and lawfully located structure or facility used in the service of the public and used to provide electric, gas, sewer, water, telephone, telegraph and other telecommunication services, without filing written notice of his intention to so remove, fill, dredge or alter, including such plans as may be necessary to describe such proposed activity and its effect on the environment and without receiving and complying with an order of conditions and provided all appeal periods have elapsed.

If homeowners proceed with a project without requesting and receiving permission fromthe conservation board, they’ll face two years imprisonment and a fine of no more than $25K. Ouch.

Credit: Pedro Correa/Inman

Cash cow or money pit?

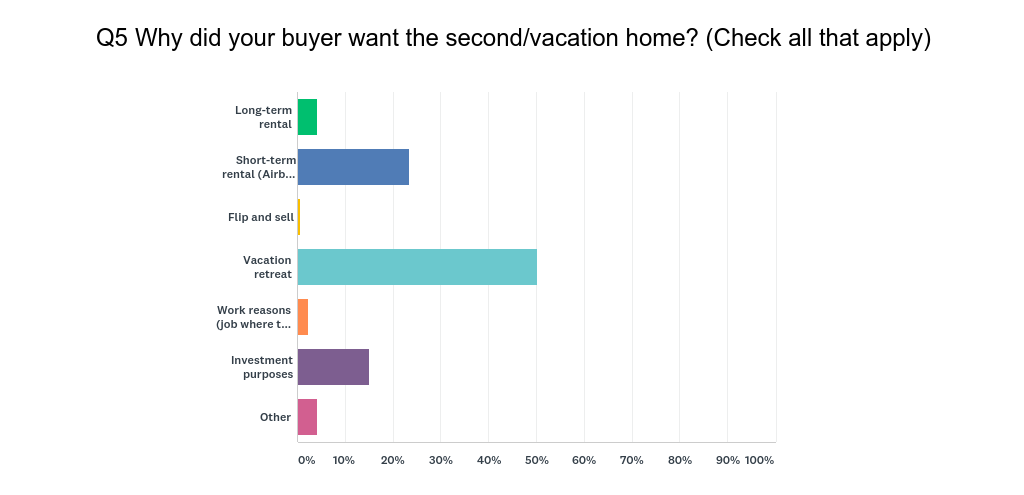

Although the majority of our survey takers (50%) said their buyer wanted a second home for the purpose of exclusive use, another 42 percent said they intended on getting into the short or long-term rental market or using the home for another investment plan.

If your buyer says they want a second home for short-term investment purposes, there are three things you and the buyer will need to consider: city and HOA short-term rental regulations, expected return on investment, and the buyer’s commitment to becoming a business owner.

Making sense of short-term rental laws

Since Airbnb, VRBO, HomeAway and other companies short-term vacation rental companies have grown in popularity, some cities have enacted strict laws that limit or ban their usage.

In 2015, San Francisco launched the Office of Short Term Rental Administration and Enforcement after issues arose with the number of illegal short-term listings in the city. Out of the 5,000 Airbnb listings in San Francisco in 2015, only 700 of the hosts were legally registered, according to a previous report by Inman.

This year, New York State Senator John Bonacic introduced Senate Bill S7182, which proposed a number of amendments to the 1929 Multiple Dwelling Law that currently bans homeowners from renting an entire home or apartment for less than 30 days. If the bill passes, short-term rentals in New York City would become “fully legal,” and the city could then collect hotel taxes from short-term rental operators.

Fully researching state, city, municipal, and HOA short-term regulations will protect buyers from purchasing a property that they cannot rent, and they’ll be able to reasonably estimate their ROI based on those regulations.

Gassett says buyers need to pay special attention to HOA regulations, which may conflict with state, city, and municipal laws. Although your city may have no restrictions on how long you can rent, he said, HOAs usually have a cap rate of 25 percent.

“I’ve had someone buy an investment property before and, at the time, [the HOA cap rate] wasn’t at the max, but it was close,” Gassett said. “Between the time they closed on it and he actually moved into the property, someone else rented their property and the neighborhood then reached capacity.”

“So he was stuck for a while before he could rent it.”

Becoming a business owner

“Any agents representing any potential buyers of [short-term rentals] must approach the property as if its a small boutique hotel,” said Peter Lorimer, who recently announced that he’s starring in a Netflix series about helping struggling Airbnb owners.

“[Buyers will] look at [the property] like it’s bonus square footage or very often it can be the junk drawer for the [primary] house where they’ll fill it with all the old furniture that they don’t use anymore, they’ll put up all the old crappy pictures in the rooms, and they’ll use their old, chipped pots and pans. This is a massive no-no.”

“When you represent your clients, be brutal. Tell them the honest truth,” he added, saying that real estate agents need to point out needed upgrades throughout the potential short-term rental home. “Say, ‘You need to retile this place. It’s probably going to cost you $5K. This stovetop is from 1955, you are going to scare away millennials who don’t even know what it is.’ ”

Beyond cosmetic upgrades, Lorimer says short-term rental buyers must learn how to create such an excellent experience for renters that they’ll generate plenty of return clients and referrals.

“Short-term rental patrons are buying an experience,” he said. “They want to experience the neighborhood through the eyes of the owner.”

Lorimer suggests providing a guestbook for each visitor that has a list of the best restaurants and attractions, and quirky things like the best place to eat pancakes after 2 p.m. on a Sunday. The kitchen also needs to stay fully stocked with water and snacks for guests.

“When you can predict what the client wants before they know they want it, you’ll receive five stars and you’ll be consistently booked,” he said.

Once again, buyers will need to invest in hiring a vacation property management company if they can’t regularly check on the home. They’ll also need to budget the cost of marketing their property, which includes professional photos and videos that will be shared on the short-term platform and across social media.

“People don’t gravitate toward the property, they gravitate toward the marketing,” Lorimer said.

Determining the profit

Once a buyer understands short-term rental laws and the upfront and monthly costs of maintaining a short-term rental, they can determine a reasonable expectation for the cash flow their property will generate.

Vacasa’s Shaun Greer says buyers need to think about two things: ROI and cap rates.

“Return on investment (ROI) is really measuring the net operating income divided by the initial investment (what they put down),” he said. “What we typically see is measuring the cap rate, which is net operating income divided by the purchase price.”

“The average cap rate would be somewhere between 5 to 10 percent,” Greer added. “We do see properties with up to 12 percent cap rates where the homeowner has explored all the opportunities to generate revenue.”

Lorimer has created his own formula which considers the level of guest service and experience, renovation costs, and the projected neighborhood appreciation.

“I start with the maximum service and experience possible, and I work backward from there to the bottom line, rather than saying I want to make 5 percent per year or I want to make 10 percent per year,” he said. “For example, I will look at a property and say it’s close to the beach, it’s close to the restaurants, and it needs $10k of cosmetic work, $5k of painting and it’s in an area that will see terrific appreciation over the next decade.”

“I’ll calculate the acquisition cost plus renovation cost, and we all want to be in the positive,” Lorimer added. “But I would rather be slightly in the positive in a great area over being massively in the positive in an area that’s questionable.”

How to sell a vacation home

Much like the process of buying a vacation home, the process of selling a vacation home often requires that agents throw traditional tactics out of the window.

To find buyers, think beyond your market

Compass Team Blair Tahoe founding partner Jamison Blair and Lake Homes Realty CEO Glenn S. Phillips say sellers’ agents have to think out of the zip code to find buyers for their properties.

Since vacation home buyers are looking to purchase a property outside of their city or state, agents don’t have the luxury of farming a specific neighborhood or zip code to find buyers as they would when selling a primary residence.

“In our market, the zip code up here in Lake Tahoe, they don’t live here,” Blair “They live in the [San Francisco] Bay Area. So, how do we get those people? We can’t just draw a little circle in our area and target that because the owners live somewhere else.”

Blair says his team relies on geo-targeting to find potential buyers. For example, he’ll create a Facebook ad targeted toward people who have been to Lake Tahoe in the past thirty days, who live in the Bay Area, and who have a net income of more than $5M. Then, as those targeted potential buyers come to Lake Tahoe, his team has plenty of print ads around the area to draw them in.

Phillips, whose brokerage is licensed to operate in 22 states, says agents need to make sure their listings are nationally syndicated and that they’re listed on specialized sites for lake homes, mountain homes, or beach homes.

“If you just put the home into the local MLS, the listing is going to be invisible to a majority of your potential buyers,” he said.

Furthermore, Phillips says agents can’t rely on yard signage and drive-by traffic to pull in potential buyers. Most lakefront communities are gated and individual homes are gated, he says, plus the terrain is rougher since most roads aren’t paved.

“The consumer isn’t driving around looking for this house, they’re online more so than for primary residence buyers,” Phillips said.

Lastly, Blair and Phillips say sellers’ agents have to be ready for a longer lead conversion timeline since vacation home buyers already have a primary home and aren’t in a rush to buy a second.

“These second homes, these vacation homes are discretionary purchases,” he said, noting that buyers often take at least two years to make a purchase. “No one has to buy one, and often, they don’t have to settle on any kind of timeframe.”

The price is right (or wrong)

Not only do real estate agents selling vacation homes have to think outside of the zip code when it comes to finding buyers, they have to think outside of the zip code when it comes to pricing the home, too.

Phillips says agents need to provide comparative market analyses (CMA) for homes in the immediate area, but they also need to provide CMAs for homes in other regions, because often times buyers are looking potential listings across multiple markets.

Furthermore, since vacation home buyers are making this purchase because they want to (and not because they need to), Phillips says they’re a bit pickier and won’t spend top dollar unless the property is perfect.

“Today’s buyer is better informed than in any time in history,” he said. “If you’re going to charge top price, the home needs to be picture-perfect move in ready. If you’re not picture-perfect move in ready, you need to be ready to adjust the price.”

To make sure a home can garner top dollar, Blair says homeowners need to deep clean the interior and invest in new flooring, which is often worn out after years of foot traffic in and out of the house. He also says spending a nice chunk of change on an updated kitchen always pushes buyers to spend a bit more.

For the exterior, Blair says careful landscaping can garner a higher sales price and often has a bigger impact than any interior cosmetic changes. He suggests that when sellers first move into a home, they begin planting trees and other shrubs that will mature and offer additional privacy and accentuate the view of the lake.

“If you can accentuate the outdoor space, I mean, that’s why everybody’s here [In Tahoe],” he said. “They really want to have an outdoor experience.”

Comments